Reporting for the Corporate Transparency Act (CTA) is approaching. Is your law firm ready?

If not, your business could face civil penalties of up to $500 per day (up to $10,000) for each violation. But with the right knowledge in your back pocket, you can prevent those costly fines.

Continue reading to learn more about CTA, its impact, and what you can do to prepare your law firm.

What is the Corporate Transparency Act?

The Corporate Transparency Act (CTA) was enacted in 2021 to improve entity structure and ownership transparency for businesses. For example, it requires reporting for companies that have foreign ownership or investment.

The main goal is to combat money laundering, tax fraud, and other illicit activities. It requires certain business entities, termed “reporting companies,” to file information on their “beneficial owners” with the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury.

The CTA cracks down on bad actors who conceal their ownership of corporations, LLCs, or similar entities to facilitate illegal activities.

Why Does it Matter and Who Does it Affect?

The Corporate Transparency Act (CTA) reporting requirements went into effect on January 1, 2024, and affects various entities operating in or accessing the U.S. market, including corporations, LLCs, and S-Corps, and impose reporting requirements on beneficial ownership information.

This is major because it doesn’t just affect large corporations. It’ll place a significant burden on small businesses and can result in criminal penalties. Aside from fines, willful violators could face up to two years in prison.

To comply with the CTA, companies must report the beneficial owner information (BOI), such as full legal name, birthdate, current residential address, and legal business name and address. This applies to entities formed or registered in or before Jan 1, 2024.

The Act will also affect law firms that represent these entities by:

- Increasing administrative burden

- Straining client relationships because of disclosure hesitancy

- Creating the need to inform and assist clients in complying with the CTA

- Requiring firms to navigate complex reporting and compliance processes

- Needing to allocate resources, staff training, and implementation of new software for managing client data securely

You may be wondering how you can meet these new standards quickly. Luckily, some legal document management tools (which you may even already be using) can be your greatest asset in keeping compliant.

How Legal Document Tools Support Corporate Transparency Act Compliant

The major benefit of having a legal document tool when it comes to CTA compliance is that it will enable your firm to document and manage all reporting information, store beneficial ownership data, and ensure all records are accurate and up-to-date at a glance.

This, in turn, helps your firm (and clients) avoid costly fines and penalties from non-compliance while improving visibility, and transparency, and building stakeholder trust/

With that being said, having a legal tool that helps you stay CTA-compliant is a must-have for 2024.

CTA Compliance Tools: Features to Look for

Whether you have a legal document management tool in place already or are looking for something to help you stay CTA-compliant quickly, you’ll want to make sure you check the following boxes:

Robust Security Features

First things first, you’ll want to take an in-depth look at the security measures your prospective software uses. What safeguards does it have to protect sensitive data? What you want is a solution that uses advanced security methods, such as encryption, multi-factor authentication, and secure, segmented access options for collected data.

This is imperative when collecting sensitive financial information that needs to be kept under tight lock and key but available for review by your team.

Quick Document Accessibility

Think about the way you’re currently storing your documents – can you access them at a moment’s notice? Losing vital documents in your inbox or endless message threads not only creates security concerns, it can prevent you from accessing necessary reporting data needed to comply with CTA.

Legal document management tools are great to have for times like these because they allow you to access collected documents when you need them, in a single reliable place. That means no more frantic searching through email threads or messages.

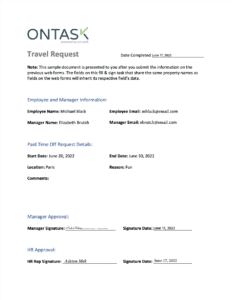

Forms to Capture Crucial Data

The CTA mandate may require you to collect new information from your clients. But to meet these standards, you need to make sure you get the right responses without errors. Choosing a tool for CTA compliance that features configurable tools can be incredibly helpful for this. This will allow you to create required fields that clients must fill out (and will greatly reduce the amount of errors or interpretation issues you have if you’ve been using paper forms).

A Spot for Your Own Branding

Using third-party software to manage and store your documents is efficient. But if you want to customize paperwork with your law firm’s logo and branding to give clients the right impression, you’ll need a platform that offers white-label solutions. Not only does this keep brand awareness top of mind for any client signing or reviewing paperwork in your tool, but it also prevents clients from opening your document and abandoning it due to unrecognizable branding.

Flexibility for New Laws & Mandates

CTA compliance matters. But so does compliance with any new laws that come out in 2024.

When the next new law comes out, you want your firm to be ready. For that reason, we suggest choosing a tool that can scale and help you adapt as legal changes continue to come your way. If you’re choosing a new tool to keep your CTA compliant, try to choose one from a company that stays abreast of business laws and updates its tool regularly with new releases.

Get with Docubee for a Partner You Can Trust

As a law firm, you understand the dire need to comply with the CTA. But you need a solution that’ll empower you to meet clients’ needs and ensure they remain compliant with the Act.

If you’re ready to adopt a simple but comprehensive solution to meet your document generation, storage, and eSignature needs, then Docubee can help.

Get a demo of Docubee today to take control of your CTA compliance needs.