For years, routine insurance processes like generating proposals and quotes, managing claims, and administering insurance policies, were tedious and repetitive.

Throw in contracts, which some insurers say is the product, and you have a workflow that’s filled with bottlenecks.

Thankfully, technological advances like quote workflows enhance insurance brokerages’ ability to provide quotes quickly and close more contracts.

But some insurers still struggle with manual contract management systems where processes are siloed and don’t interact with one another. This means more back and forth between departments before even executing a contract.

And, multiple versions of contracts often exist, leading to more confusion or heavy financial liability for the insurer later on.

With no contract tracking system, it’s easy to miss important steps and miscommunicate vital data in the contract to other systems.

That’s where contract automation comes in, which reduces the lag time and window a customer has to opt for a competitor and close more contracts.

This guide covers everything about insurance contract automation and how to implement it in your brokerage to systemize your contract acquisition efforts.

What is Contract Automation?

Contract automation is the use of contract management software to auto-generate contracts using data saved on a business’s system.

Let’s face it, the manual contract process is tedious, time-consuming, and error-prone, causing bottlenecks and friction — especially when it’s repetitive.

Manual systems also open your business to risks with:

- Delays: Manual processes can take days or weeks to create, approve, and sign off simple contracts. This delays closing contracts and increases pressure on your employees.

- Duplicity: Creating contracts from scratch is a time suck and often leads to duplicated efforts, particularly when using word processing tools. Most times, contracts have multiple versions across the business, or worse, stored as printed copies in filing cabinets. Version control risks also increase when teams use outdated versions of contract templates (these are key to standardizing your contracts).

- Risk of error: Many variables like language, discounts, and warranties expose manual processes to the risk of error. Things can get lost, or mistakes are made, which may cause serious issues later — especially for contracts with sensitive information.

- Wasted time: Manual contract management processes deny your business many potential opportunities because you can’t close deals or provide offers promptly.

- Poor customer experiences: 89% of consumers expect companies to accelerate their digital initiatives. With manual and rigid contract management processes, your brokerage won’t stand out — even if you claim to be disruptive and innovative. So the best option is to digitize your processes.

Contract management automation creates more efficient contract workflows, digitizing the repetitive and manual nature of creating, storing, and managing contracts.

Manual contract management triggers a back-and-forth email chain, which doesn’t track negotiations efficiently, and — at some point — everyone may lose visibility of the document.

Contract automation ensures insurance brokerages deliver the efficiency of an automated contract lifecycle without sacrificing collaboration, negotiation, and tracking.

Contract Management Automation Solutions Are The Future of Doing Business

A survey by the World Commerce and Contract shows an average of 25% of employees are involved with contract management.

The dramatic events created by the global COVID-19 pandemic saw more consumers transacting digitally, awakening business executives to their outdated contract process.

Insurance contracts are no exception. In fact, more insurers are using contract automation software than manual paper and ink because of the sheer volume and complexity of contracts.

Contract management automation technology is critical at this transactional end of the spectrum. During the pandemic, insurance brokerages that had already invested in contract management systems benefited the most. They responded faster and more efficiently to their customers’ needs.

These tools not only shorten the signing process but also have a centralized way of storing contracts and automating the steps in between. The result: increased efficiency, better regulatory compliance, and more positive customer service, which impact future purchase considerations.

The challenge for insurers relying on pen and paper is to get on the digital bandwagon or risk being left behind technologically or losing customers and revenue.

Why Contract Automation is Becoming More Important for the Modern Insurance Brokerage

Companies today are no longer judged solely on what they do, but how they do it.

According to Value Penguin, 66% of consumers spend 30 minutes to two hours shopping around for insurance. Sixteen percent say it takes less than 30 minutes.

For insurers, this implies more consumers are getting their quotes online. So, their customer experience — from quote to contract signing and beyond — needs to match the speed and efficiency of digital processes.

Unfortunately, some insurance brokerages pivot the customer experience from digital to manual paper and ink. A slow customer experience adds a lot of friction, and insurance agents risk losing customers.

Smart insurers know automated contract management is the future. That’s why they tap into the power of technology to deliver delightful customer experiences.

They also know that the opening of the market and emergence of new players and digital disruptors in the insurance business can leave them in the dust. In a field that’s dense with opportunity, insurers can no longer afford to remain rigid and tied to out-of-date dynamics.

Here’s how contract automation software can transform your insurance brokerage.

Centralized storage

Contract management software lets you store contracts safely and securely while providing searchable repositories so you and your team can find the right document in seconds. This eliminates time wastage, expenses, and the risk of contract generation.

Legally binding

A key question for insurers looking at contract automation technology is whether it satisfies regulatory and legal objectives. Contract automation software makes the contract process more efficient for your business and customers while preserving the legally binding and enforceable nature of the contracts.

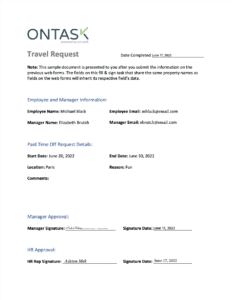

Templated contract generation

Creating contracts can be a drain on your time and resources. With contract management software systems, you get a library of professional, well-designed contract templates for your insurance brokerage. That way, you save time and reduce the likelihood of human error.

Automated workflow

It can take a long time to get contract approvals, especially when working with different people across multiple departments. Contract automation tools provide automated contract workflows that can dramatically cut down the back-and-forth emails and time spent chasing down signatures.

Streamlined new contract acquisition

Automated contract processes eliminate the tedious, time-consuming, manual steps, freeing your team to do more strategic work — including finding new customers.

Errors and delays become a thing of the past, relevant information is a click away, and your contract acquisition is more streamlined. This makes it easier and faster for you to onboard new customers.

Insurance Contract Automation is Helping Brokerages Grow

Modern insurance brokerages understand the power of automated contracts and are leveraging it — especially in back-office operations — to transform the contract management experience.

Automated contract drafting brings cost and time savings, makes the contract process faster and more efficient, and simplifies negotiation and collaboration between your team and customers.

In this way, insurers can remain agile and scalable in today’s economic environment.

Systemize Your New Insurance Contract Acquisition Efforts with Docubees’ Contract Automation Software

Rapid technological advances in the next decade will result in disruptive changes for insurance brokerages.

McKinsey believes the winners in contract automation will be insurer carriers that use new, advanced technologies to streamline their processes, reduce costs, and exceed their customers’ expectations for personalization and dynamic adaptation.

With Docubee, you can automate your contract management lifecycle. Our software eliminates the extra steps of contract generation, offers customizable document workflows, and secures integrations with other apps for contract storage.

Plus, contracts signed in Docubee are legally binding, and have audit trails, meaning you can protect yourself if challenged in a court of law.

Ready to automate your contract management process? Try Docubee for free today!